tax shelter real estate investment

To begin with what are tax shelters. And its an investment asset.

5 Tax Deductions For Rental Property Bankrate

EDT 2 Min Read.

. 1 day agoA real estate transfer tax that would be higher for property sales exceeding 1 million would help the city fight homelessness. Investing in commercial real estate offers many unique tax benefits primarily the ability to claim depreciation deductions on income-producing properties and defer capital. The result is that rental real estate is a secret tax shelter that few people ever consider.

While retirement-related tax shelters rank right at the top of the list real estate investing is among the top tax shelters as well. A tax lien is a claim the government makes on a property when the owner fails to pay the property taxes. Welcome to Westdale Real Estate Investment and Management.

In simple terms a tax shelter is a means for real estate investors and property owners to store assets so that their current and future tax rates are minimized to the fullest. For each two dollars of AGI over 100000 the 25000 limit is reduced by one dollar. To see how a real.

A tax shelter is advantageous by the taxpayers in high tax brackets so they can take losses from it to reduce their taxable income. For singles for example from 0 to 10000 they pay 10 from 10000 to 40000 they pay 12 from 40000 to 80000 they. Story continues below.

Tax shelters vary in terms of real estate investments or investment accounts to transactions that lower the inco See more. 2021 Shelter Real Estate Investment Strategies. After 2012 28 tax reforms brackets have changed.

We specialize in buying distressed properties multi-family commercial retail. Tax lien investing is the act of buying the delinquent tax lien on a property and earning profits as the property owner pays interest on the certificate or from the liquidation of the collateral. Therefore an investor whose adjusted gross income is 120000 would be limited to a 15000 tax.

5E Real Estate is one of Richardsons top real estate investing groups because we focus on doing things right. As knowledgeable replacement property professionals they help clients build a customized strategy that identifies suitable investments pursuing successful completion of a. IMGCAP 1In every country Ive been in real estate is the best tax shelter said Tom Wheelwright CPA an advisor and speaker at.

There is a penalty of. To shelter real estate investment cash flow from taxes emphasize to investors that they can buy like-kind properties through tax-free exchanges also referred to as a Section. Liens are sold at auctions that sometimes involve bidding wars.

July 16 2015 331 pm. They had stayed at one of the citys emergency. A number of real estate tax shelter exist.

Westdale Real Estate Investment and Management Westdale is a national real estate investment and.

Tax Shelters For Real Estate Investors Morris Invest

Tax Shelter Options For Fix Flips And Rental Properties

The Unofficial Guide To Real Estate Investing Unofficial Guides Strauss Spencer Stone Martin 9780764537097 Amazon Com Books

11 Ways To Significantly Lower Your Taxes As A Real Estate Investor

Running For The Tax Shelter Turbotax Tax Tips Videos

To Pay For The Pandemic Dry Out The Tax Havens And Make Apple Pay Taxes

Tax Benefits Of Rental Property

The Search For A Safe Tax Shelter Wsj

Great Tax Benefits Of Real Estate Investing

Federal Tax Rules Create Advantage For Real Estate Investment Trusts

Tax Strategy Tuesday Avoid Real Estate Net Investment Income Tax Evergreen Small Business

What Is The Biggest Tax Shelter For Most Taxpayers

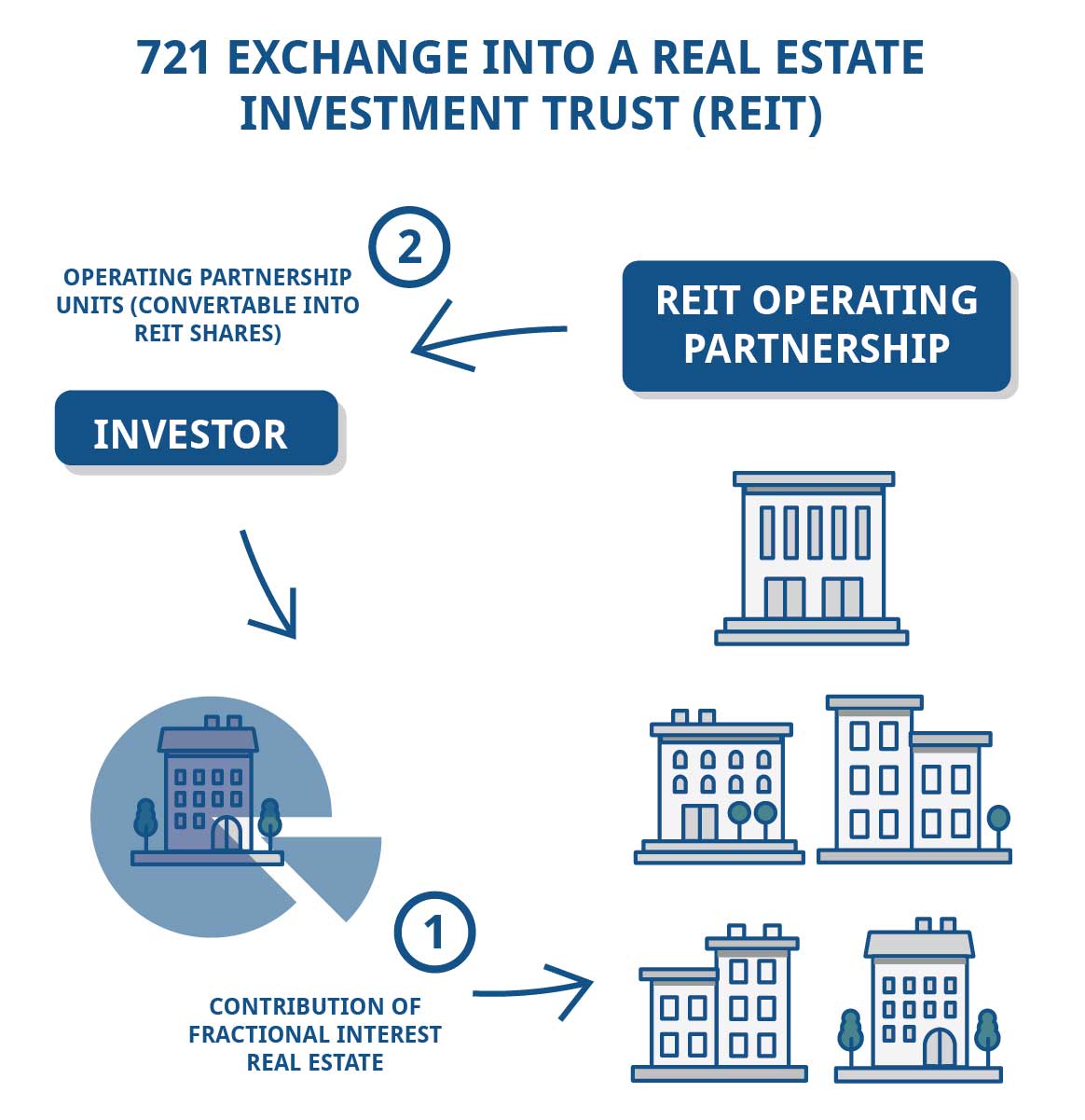

Introduction To The 721 Exchange Jrw Investments

What Is A Tax Shelter And How Does It Work

Using Real Estate As A Tax Shelter Mashvisor

Riscario Insider The Two Drawbacks Of Investing In Life Insurance

A Primer On Real Estate Professional Status For Doctors Semi Retired Md